Personal financial difficulties are often brought about by circumstances outside the individual’s control and through no fault of their own.

We recognise that financial difficulties bring extreme pressure, and can often lead to emotional, health and relationship issues which may be life-changing. We understand that compassion and empathy are just as important as technical knowledge and finding a decisive solution.

Whether you have incurred personal debts through business activities, or if you’re struggling with credit cards, store cards or personal loans, you have no need to try and cope alone. We can help. No matter how complicated or difficult your financial problem may seem to you, our team will have seen that problem before. We’ll take time to understand your problems and we’ll provide down to earth advice. The solution we suggest will be practical, tailored to your specific personal needs, and help you put your debt-related problems behind you. And our initial advice will always be free and without obligation.

The tri group approach

Calling on the services of a firm like ours inevitably means that there are serious problems to address, usually urgently. In summary:

We are committed to helping businesses with financial pressures to overcome those problems; we regard winding up as the last resort.

We’ll explain the process using clear, jargon-free language, and set out the issues that the client will need to address. We’ll support the client throughout the process.

An initial meeting will always be without charge or obligation. We do not charge clients for the privilege of explaining their problems to us.

Professionalism, Integrity and Compassion matter to us. We will always be driven by the need to provide the best possible advice, not to maximise our fees. We are interested in building long-term relationships with professional advisers.

When formal insolvency is unavoidable, we will help select the most appropriate procedure for the particular circumstances so as to achieve the most beneficial outcome for creditors, guarantors and other stakeholders.

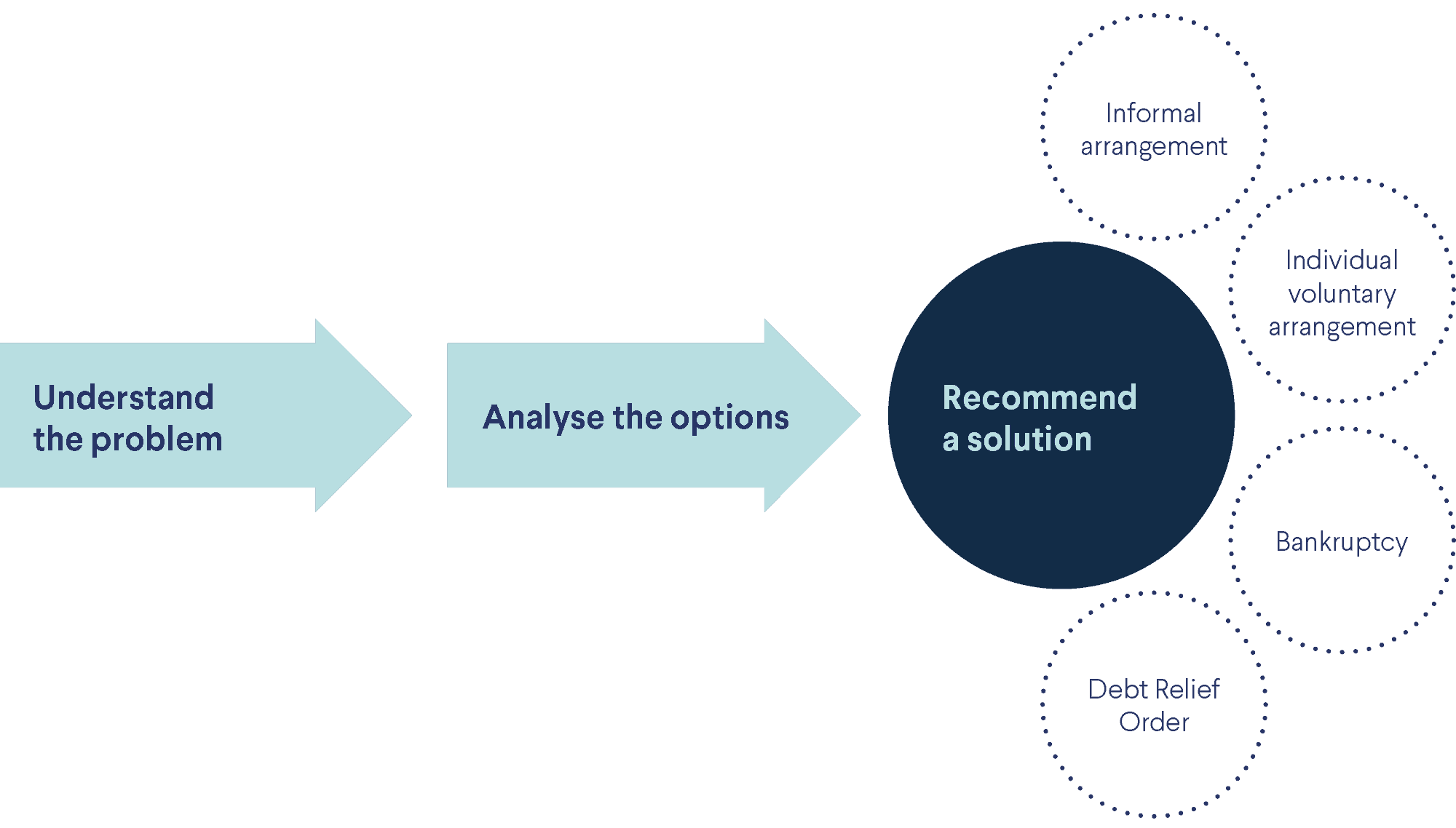

We’ll spend time listening carefully and making sure that we fully understand the problems before we analyse the options.