When the going gets tough it’s vital that advice is obtained as soon as possible. The earlier we’re brought in the better the prospect of finding a solution that will allow the business to survive; rescuing a business is always our first objective.

We start by making sure that we understand the reasons for the difficulties and seeking to address them. We’ll work with you to manage your cash flow and working capital, and to deal with the needs of key stakeholders such as bankers and major creditors. Then we’ll work with you to identify and address the causes of under-performance and develop a strategy to restore stability to the business and bring about improvement.

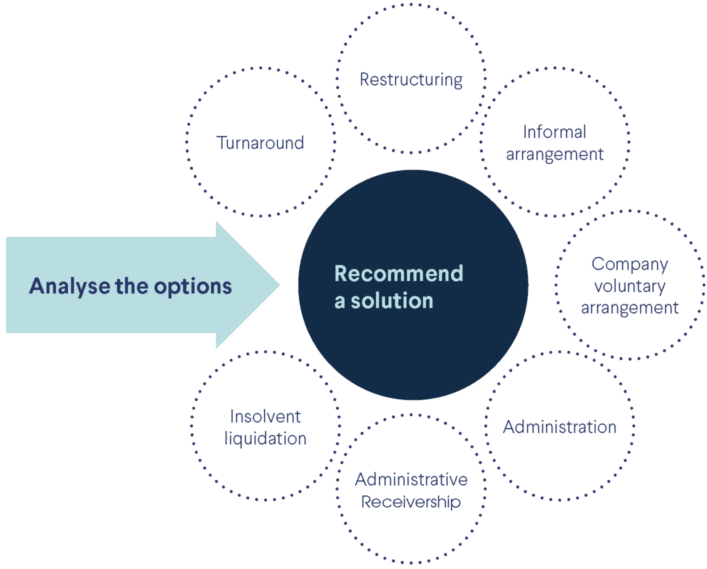

If necessary we can use formal procedures such as administration or a company voluntary arrangement to provide protection from creditors and negotiate legally binding compromises.

Even where the financial problems are insuperable and recovery is not viable, we’ll find the most suitable solution which provides the best outcome for all concerned, maximising the outcome for creditors and minimising the exposure of guarantors. In some circumstances it may even be possible for the existing management to be involved in the business in the future.

Our team has vast experience, with a successful track record of handling assignments, from the smallest to the largest, from the straightforward to the most complex, and across a wide range of industries and sectors.

The tri group approach

Calling on the services of a firm like ours inevitably means that there are serious problems to address, usually urgently. In summary:

We are committed to helping businesses with financial pressures to overcome those problems; we regard winding up as the last resort.

We’ll explain the process using clear, jargon-free language, and set out the issues that the client will need to address. We’ll support the client throughout the process.

An initial meeting will always be without charge or obligation. We do not charge clients for the privilege of explaining their problems to us.

Professionalism, Integrity and Compassion matter to us. We will always be driven by the need to provide the best possible advice, not to maximise our fees. We are interested in building long-term relationships with professional advisers.

When formal insolvency is unavoidable, we will help select the most appropriate procedure for the particular circumstances so as to achieve the most beneficial outcome for creditors, guarantors and other stakeholders.

We’ll spend time listening carefully and making sure that we fully understand the problems before we analyse the options.