As a business owner you have lots of plates to spin at the same time, sometimes the plates start to wobble but with early intervention and some support, disaster can be avoided. We are a team of Business Turnaround, Restructuring and Insolvency Professionals, who can support you in managing your business particularly when the plates begin to wobble. We have 10 Business Financial Health Check questions that should identify if you require our support or support from our professional contacts. Answering these questions should identify any potential issues that are avoidable and the actions you should consider.

The questions in this tool are intended to enable you to consider your current position generically, and not as a replacement for professional advice, specific to the needs of your business and its situation.

We always advise you to speak to one of our team in person for a specific review of your business. We are happy to discuss your business and any issues face to face we will then provide you with a specific report that is written taking further detailed information into account.

Download for free your Business Financial Health Check

We are here to answer any question you have about your financial options, just contact our offices. We’re available Monday to Friday, from 09:30-17:00 to take your call in confidence.

The tri group approach

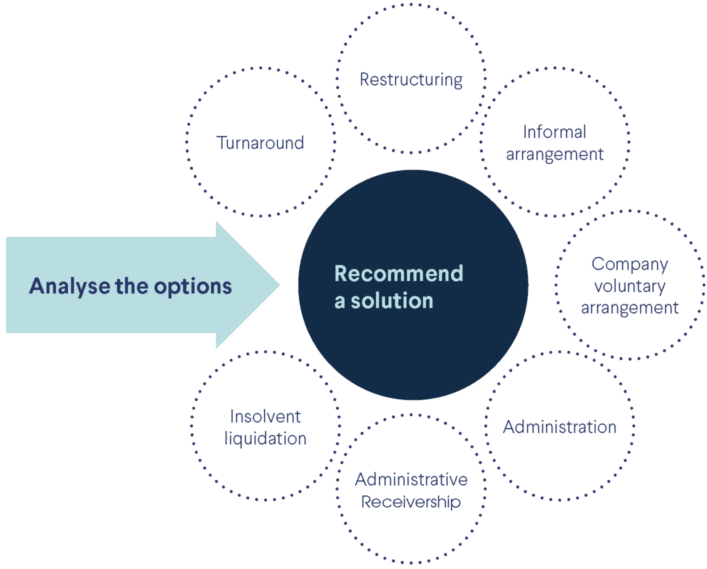

Calling on the services of a firm like ours inevitably means that there are serious problems to address, usually urgently. In summary:

We are committed to helping businesses with financial pressures to overcome those problems; we regard winding up as the last resort.

We’ll explain the process using clear, jargon-free language, and set out the issues that the client will need to address. We’ll support the client throughout the process.

An initial meeting will always be without charge or obligation. We do not charge clients for the privilege of explaining their problems to us.

Professionalism, Integrity and Compassion matter to us. We will always be driven by the need to provide the best possible advice, not to maximise our fees. We are interested in building long-term relationships with professional advisers.

When formal insolvency is unavoidable, we will help select the most appropriate procedure for the particular circumstances so as to achieve the most beneficial outcome for creditors, guarantors and other stakeholders.

We’ll spend time listening carefully and making sure that we fully understand the problems before we analyse the options.